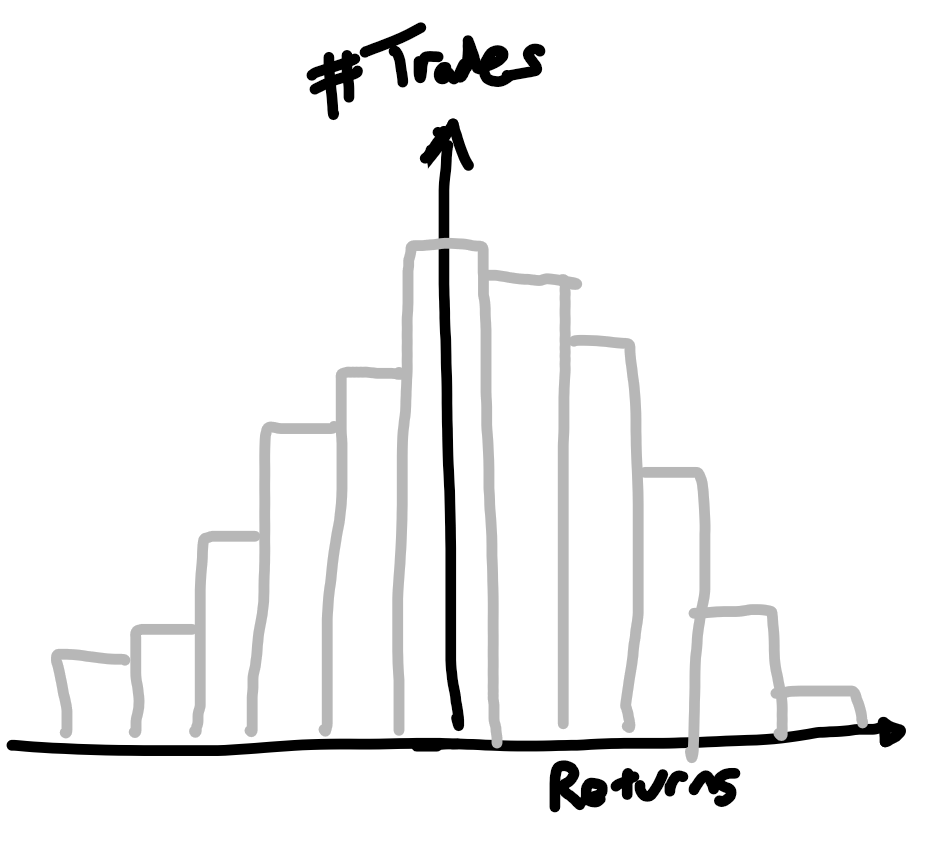

What P&L Swings Can I Expect as a Trader?

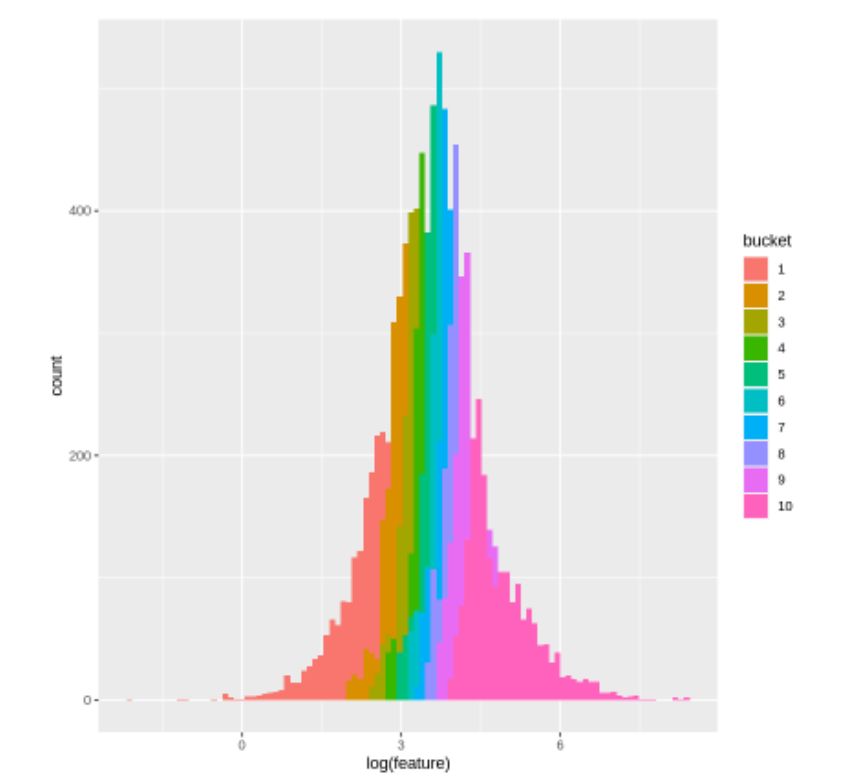

Many beginner traders don’t realize how variable the p&l of a high-performing trading strategy really is. Here’s an example… I simulated ten different 5 year GBM processes with expected annual returns of 20% and annualized volatility of 10%. (If you speak Sharpe Ratios, I’m simulating a strategy within known Sharpe 2 characteristics.) I plotted the …