The first fundamental problem traders run up against is that there’s no beginners’ market.

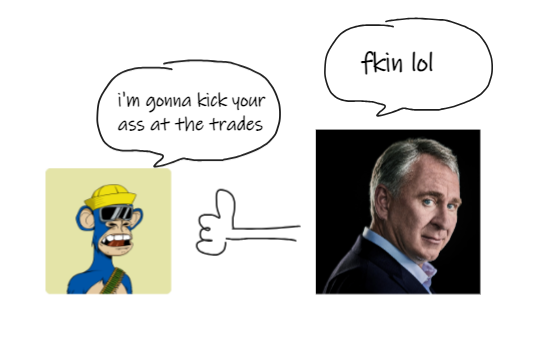

You have to compete for good prices with the best in the market.

This is a problem. There are a lot of people better at markets than you.

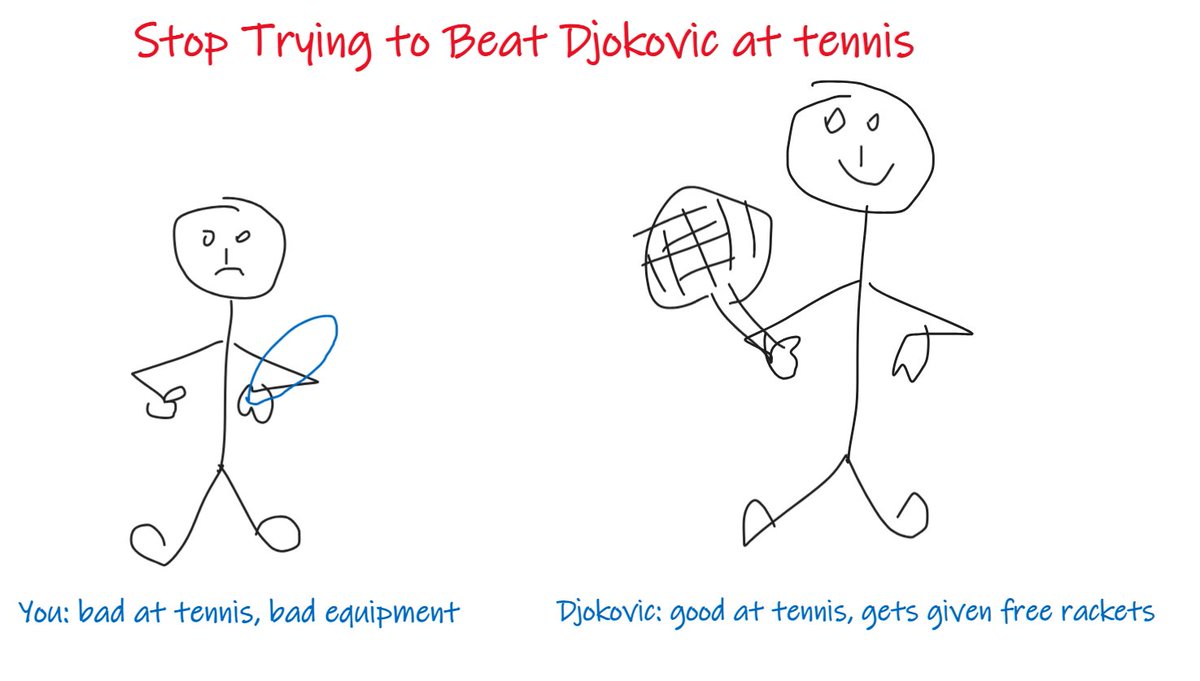

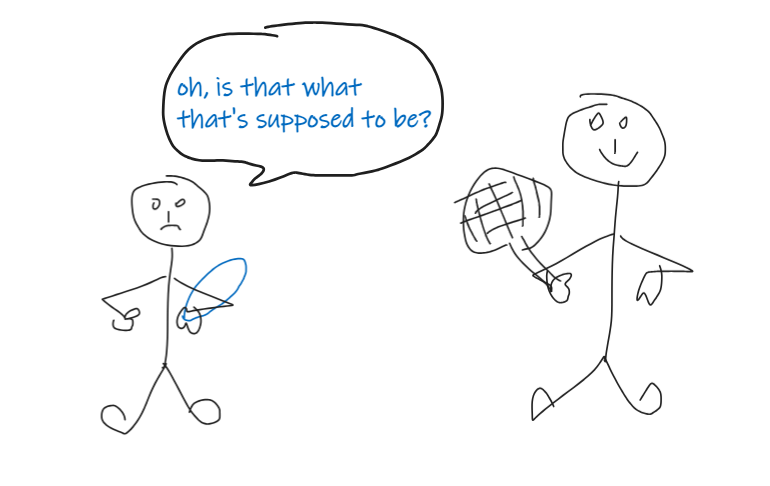

If you approach trading in a gung-ho manner, it’s basically like playing in a tennis competition with Djokovic.

And that’s not going to go well.

Because he’s very good at playing tennis and you’re bad at it.

(sorry to break it to you)

What do I mean about “competing for prices with the best in the market”?

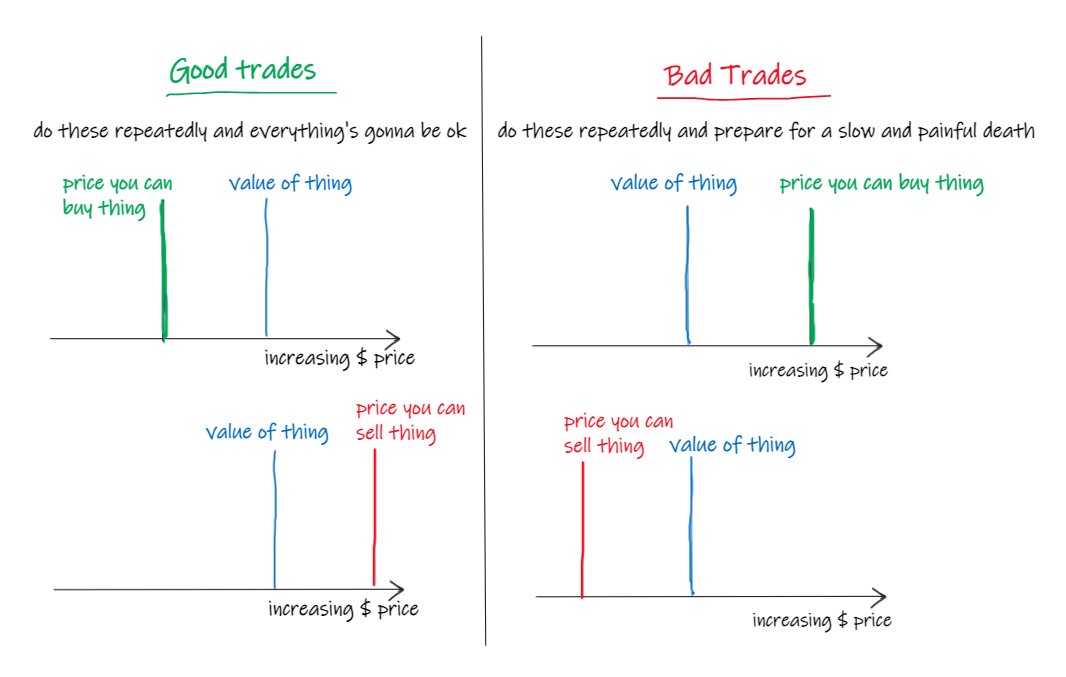

Well… to make money trading, you need to be buying things that are too cheap and selling things that are too expensive.

You need your side of the trade to be good and the other side of the trade to be bad.

At least on average, anyway.

Take enough good trades, manage your risk sensibly, and everything else will look after itself over time.

It turns out it’s not hard to find people who are prepared to trade at the wrong prices.

There are plenty of terrible traders about.

The problem is that it is hard to get the opportunity to trade with those people.

You’re competing for those opportunities with the best in the market.

And they’re smarter and faster than you.

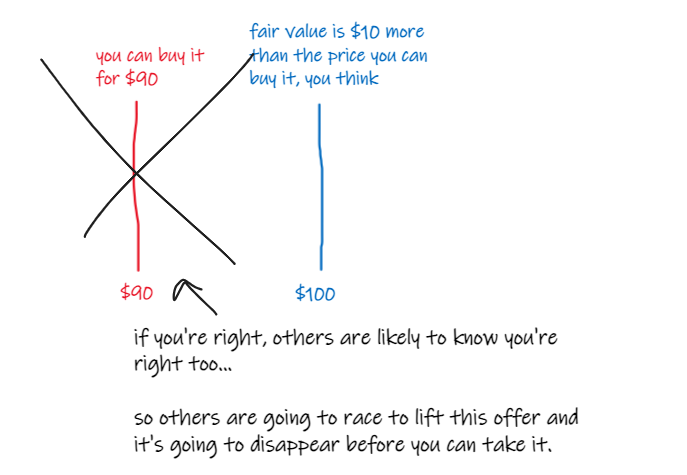

Imagine an asset is offered at $90 but you think it’s worth $100 – someone is willing to sell it at a $10 discount, you think.

Maybe you can buy it at a $10 discount then?

But what is obvious to you is obvious to others, too.

If you are right, other traders will think this is cheap too, and they aren’t going to leave that opportunity lying around.

It’s going to get bought quickly and the opportunity will disappear.

So you’ll likely miss the good trade.

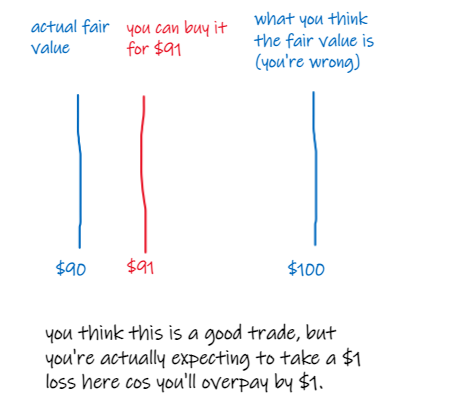

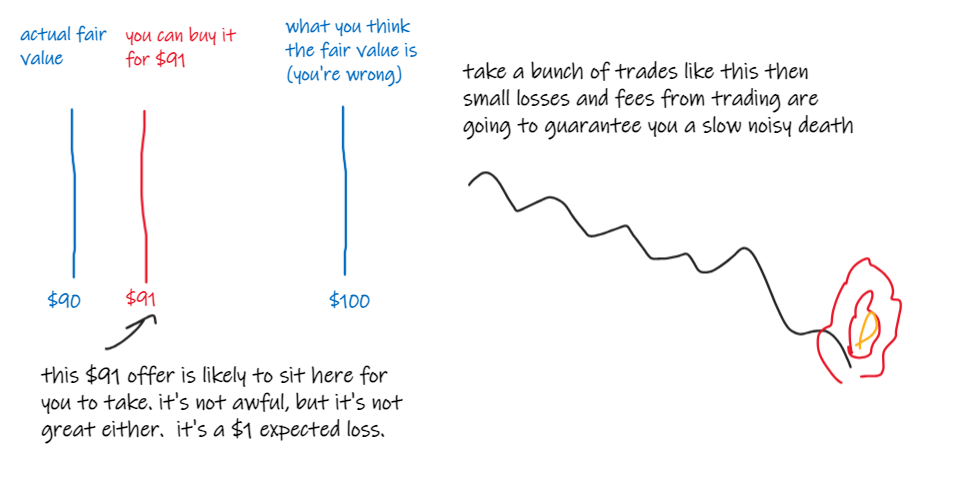

Now, imagine that the same asset worth $90 is offered at $91 (something like this would be the normal situation).

It’s offered at $91 (slightly rich) – but you think it’s worth $90. You think it’s cheap.

Now, for the sake of the example, you’re wrong.

That $91 offer isn’t likely to go anywhere quickly.

It’s likely to sit there for you to take

That $91 offer is uncompetitive so you take the bad trade.

It’s not a terrible price, but it’s not a good price either.

Take a bunch of trades like this, and small losses along with fees are going to guarantee you a slow noisy death.

Financial markets are extremely competitive.

There’s no beginners’ market.

You’re trading in that market in competition with the best trader in the world. That trader is going to take all the good prices and leave you with the rubbish ones.

As a beginner and new entrant into the market, you can’t go gung-ho into competing with the best at their own game.

You need a better plan than that.

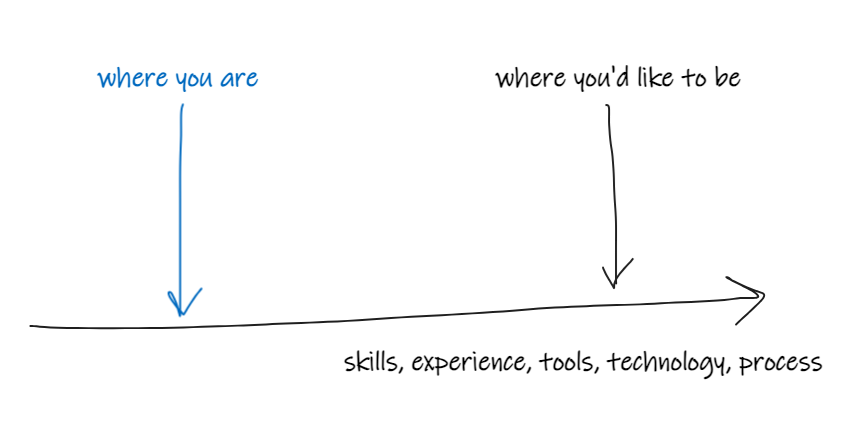

And it needs to be a realistic plan, based around what you can compete in TODAY.

You might have lofty goals for the future… but right now, you only have a certain level of skills, experience and tools.

You need a plan to take advantage of what you have NOW, not what you wish you had.

Every day as traders, we must ask, “How can I give myself the best chance of making money TODAY, given where I am TODAY?”

(That’s the question to ask first, above all else).

Realistically, this requires:

- competing as little as you possibly can

- maximally exploiting any small advantages you might have.

As a new tech startup, you wouldn’t just jump into the market and try to compete with Microsoft.

You’d try to carve out your own niche that they weren’t interested in.

And it would be something USEFUL that people wanted to pay you for.

But also something that’s AWKWARD and uncompetitive. something that didn’t scale well, perhaps. Like most business endeavors it really comes down to “doing useful things that suck.”

- “doing useful things…” (that people want and will pay for)

- “that suck” (otherwise you’d have loads of competition)

Trading is like plumbing.

You want to be doing useful things that other people don’t want to do.

You don’t want to be trying to out-smart and out-gun other traders in a highly competitive zero-sum game.

You can’t win like that.

So don’t just consume a bunch of economic data and news and expect you’ll figure out macro scenarios better than the market.

That ain’t gonna happen. You’re trying to beat Djokovic at macro tennis.

And don’t try to model companies’ financial projections better than the mass of analysts and pod hedge fund types trying to do the same.

That ain’t gonna happen either. You’re trying to beat Djokovic at Excel tennis.

And don’t stare at the order book or jupyter notebooks, trying to beat the quants and supercoders at high-frequency order book games.

You have no chance. You’re trying to beat Djokovic at HFT tennis over dial-up.

And definitely don’t try to predict directional moves using chart patterns or Elliot Waves or something.

That’s never gonna happen. That’s like trying to beat Djokovic at tennis, but you brought a dildo instead of a racket, and you’re retarded.

Rather, you want to be looking to do useful things people value in as uncompetitive an arena as you can.

This typically involves:

- taking on (and managing) risk that others are keen to avoid

- trading against price-insensitive participants in constrained or stressed markets

what does that mean in the real world?

Trade Like a Quant Bootcamp has tons of examples of real systematic trading strategies based around these concepts.

It takes a bit of humility to play these games (you can only eat what you’re fed).

And it takes discipline and commitment to prioritise doing your best to make money TODAY over other considerations.

But there are simple things you can do that will give you a good chance of actually making money if you stay on the straight and narrow.

2 thoughts on “Stop Trying to Beat Djokovic at Tennis”