Everything Everywhere All at Once

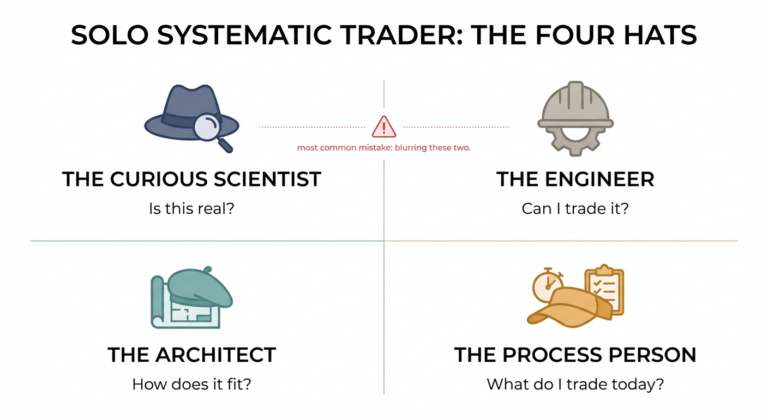

The four hats of the solo trader At a trading firm or fund, the researcher doesn’t run the execution desk.

The four hats of the solo trader At a trading firm or fund, the researcher doesn’t run the execution desk.

Part 3 of a series on Statistical Arbitrage for Independent Traders Previously: In the last article, we built up a

Previously: A Tale of Two Prices (the core idea of stat arb) Last time we established that stat arb is

Part 1 of a series on Statistical Arbitrage for Independent Traders. It was the age of wisdom, it was the

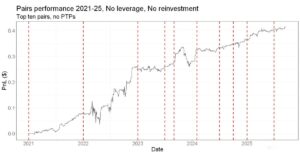

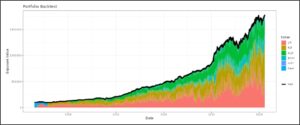

What’s Past is Prologue Let’s be honest: 2025 was a pretty good year to be a systematic trader. If you

Traders love the illusion of precision. A few bad weeks go by, and you think, “Let’s run a t-test and

When I first got interested in trading, The Whitlams were all over Australian radio, and I was making all the

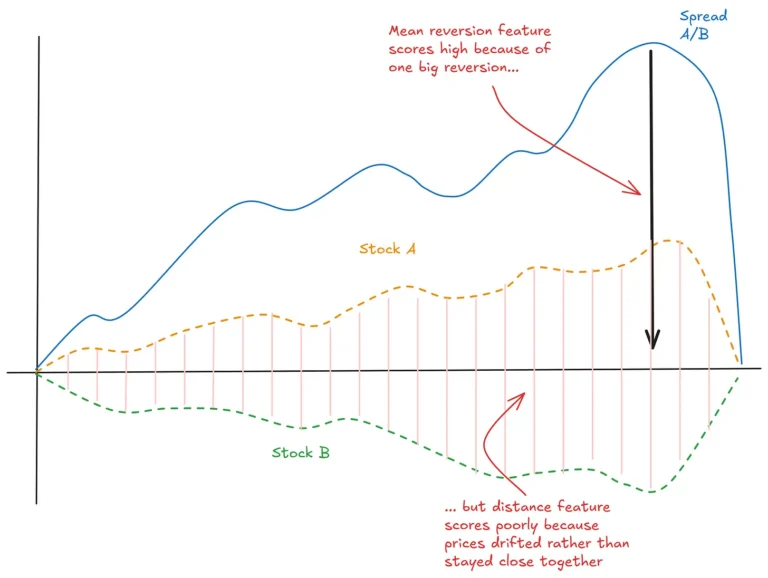

How do we find edges? First, we must be clear about what constitutes a good idea. It isn’t as simple

We’ve all used on/off type trading signals at some point. But you can nearly always extract more insight with a

Do you find yourself obsessing over p-values and t-stats when evaluating trading ideas? I get it. If you come from

The market is a highly competitive beast. If you’ve spotted an edge, others have too. And as capital piles in,

Recently, we had an excellent question on the Trade Like a Quant Discord server: “How do you know if your