Evolving Thoughts on Data Mining

Several years ago, I wrote about some experimentation I’d done with data mining for predictive features from financial data. The

Several years ago, I wrote about some experimentation I’d done with data mining for predictive features from financial data. The

I have been sharing examples of simple real-time trading research on my Twitter account. I do this kind of thing a

I’m a big fan of Ernie Chan’s quant trading books: Quantitative Trading, Algorithmic Trading, and Machine Trading. There are some

The S&P index committee recently announced that Tesla, already one of the biggest stocks listed in the country, would be

Colaboratory, or Colab, is a hosted Jupyter notebook service requiring zero setup and providing free access to compute resources. It

You rarely meet a rich forex trader. I’ve met plenty of rich traders who trade quant factors or stat arb.

Here’s a chart of long-term asset performance…. The blue line shows returns from US stocks from 1900 to today.

I recently listened to a podcast about one of the earliest human civilizations – the ancient Sumerians. Apparently, our system

I was very sad to learn that Quantopian is shutting down its community services. Quantopian’s efforts to bring quant finance

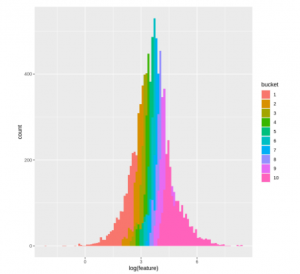

This post presents an analysis of the SPY returns process using the QuantConnect research platform. QuantConnect is a strategy development