When you do anything with data, you should think about the intuition of each thing you do, and what it represents “in the real world”.

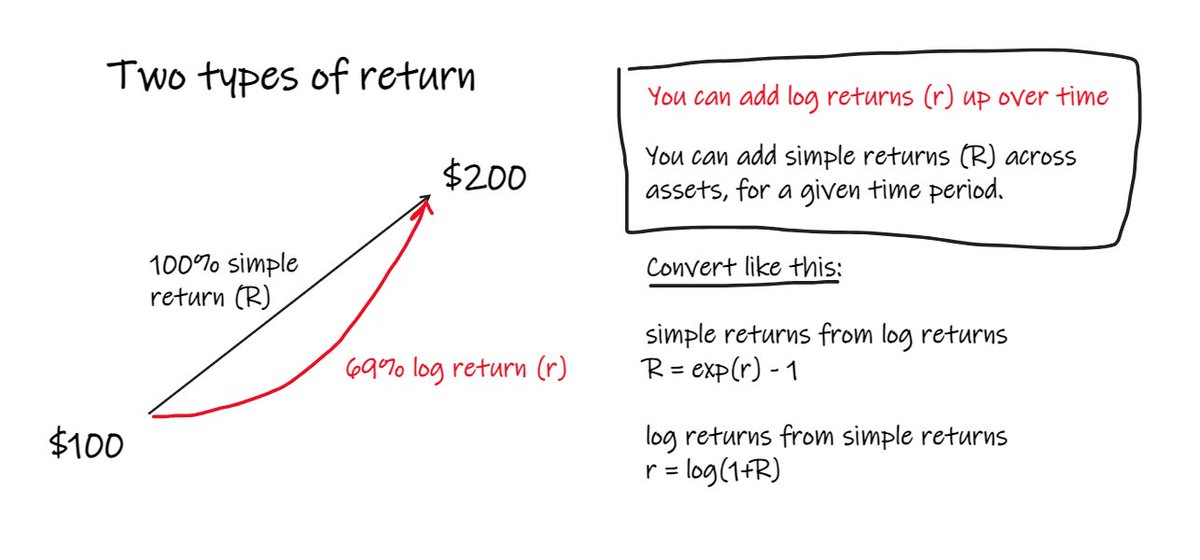

Let’s take the example of log returns, which some people tell me they find confusing.

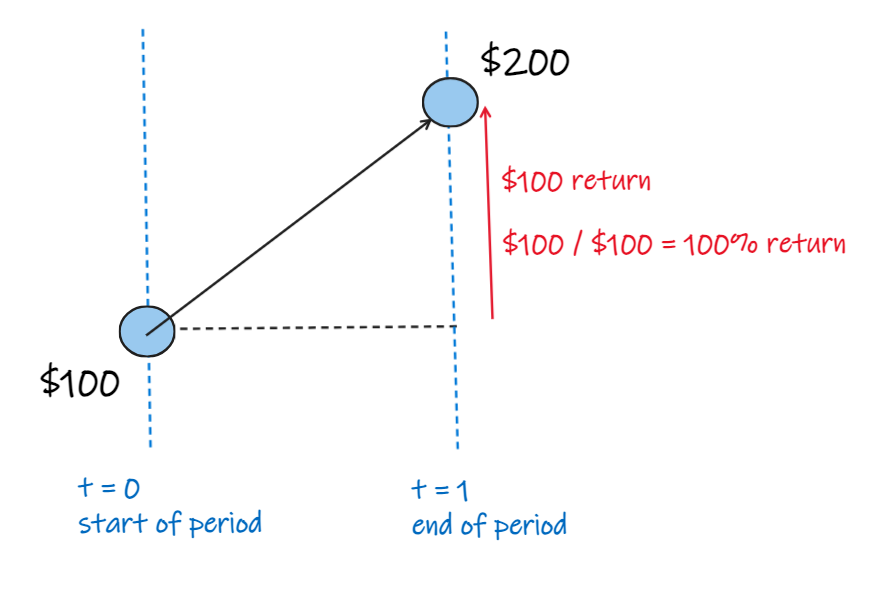

Consider an asset whose price goes from $100 to $200

Assume there are no other cash flows like dividends associated with this thing.

What are the returns for being long?

The intuitively obvious answer is 100%.

It went up $100, the same as its price at the start of the period.

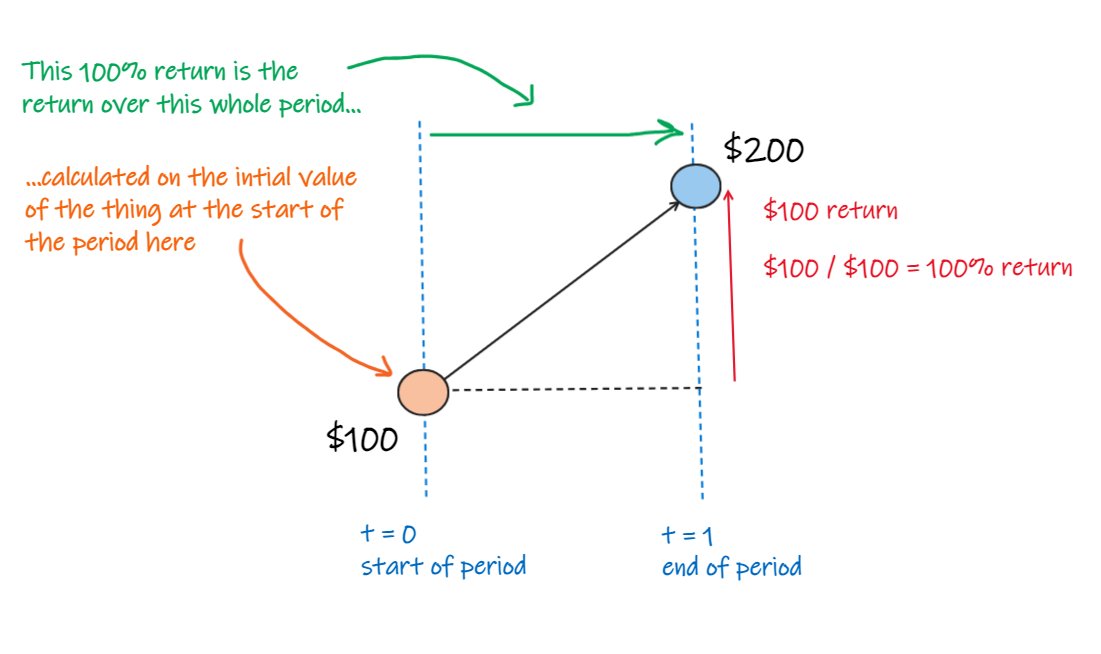

But let’s be careful we understand what that represents.

That represents the return:

- Over the whole period, and

- Calculated on the initial value at the start of the period.

To be tediously clear:

- The asset was worth $100 at the start.

- It increased by $100.

- So the total return over the period on the initial value is 100%.

We might call this the periodic arithmetic return. Or simple return.

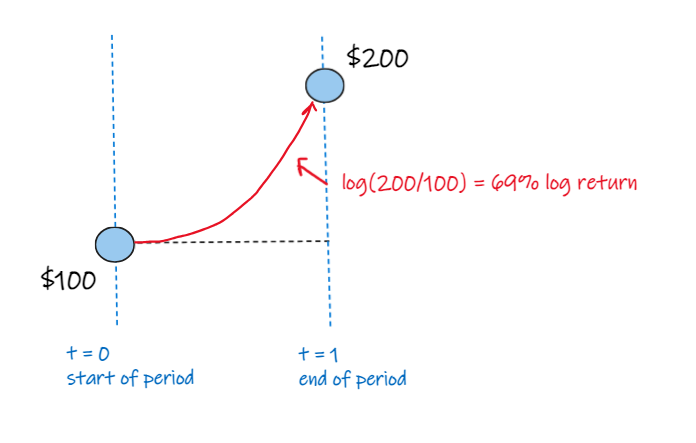

Now let’s consider log returns.

We calculate log returns for this period as log(200/100) = 69%

That’s lower.

What does it represent?

It represents the return that we’d apply continuously throughout the period (rather than to the price at the start) to get to the end price.

I told you the answer, but if it’s your first time thinking about this seriously, that probably won’t have made any sense.

So let’s go through it slowly.

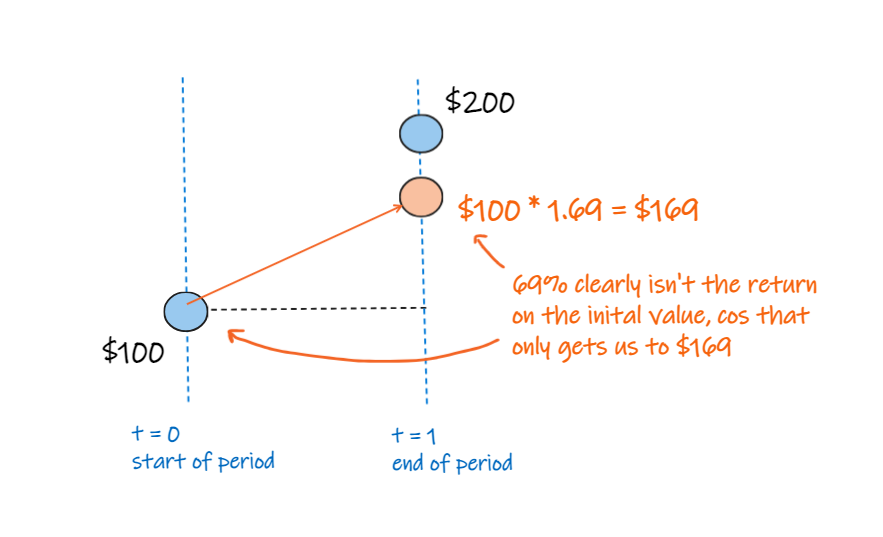

It’s obvious that 69% isn’t the return over the period on the initial value because that would only get us to $169, not $200.

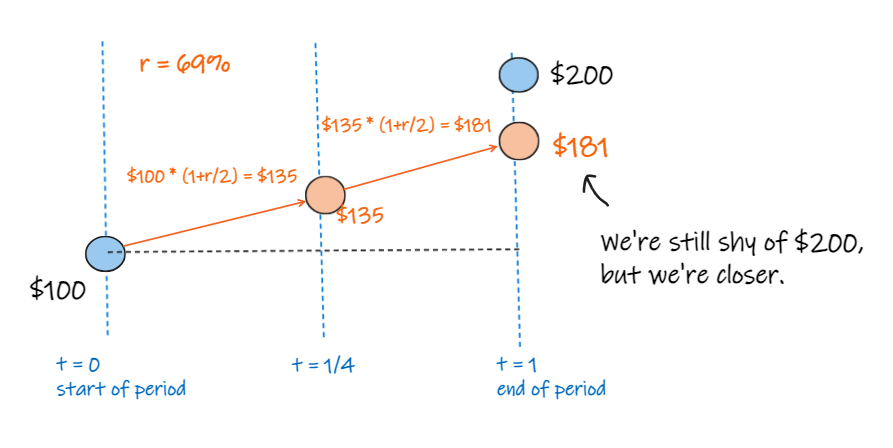

Now let’s split our period into two.

We’ll apply a return of 69% / 2 to the first period to get $135.

Then apply a return of 69% / 2 to $135 to end up at $181:

Which still isn’t $200, but it is closer.

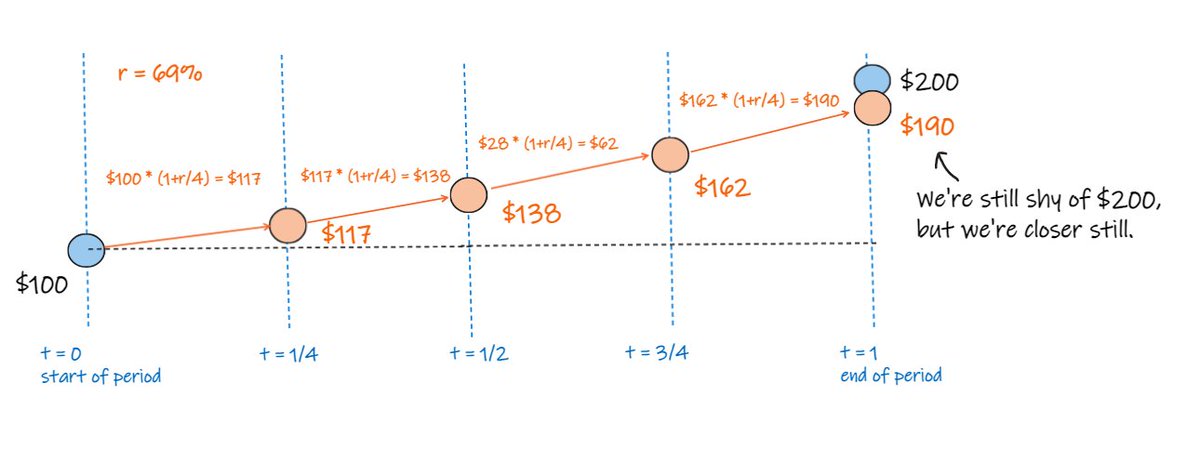

Now, let’s split our period into four.

And apply a return of 69% / 4 to each of the four periods.

Now we end up at $190:

Which still isn’t $200, but is closer still.

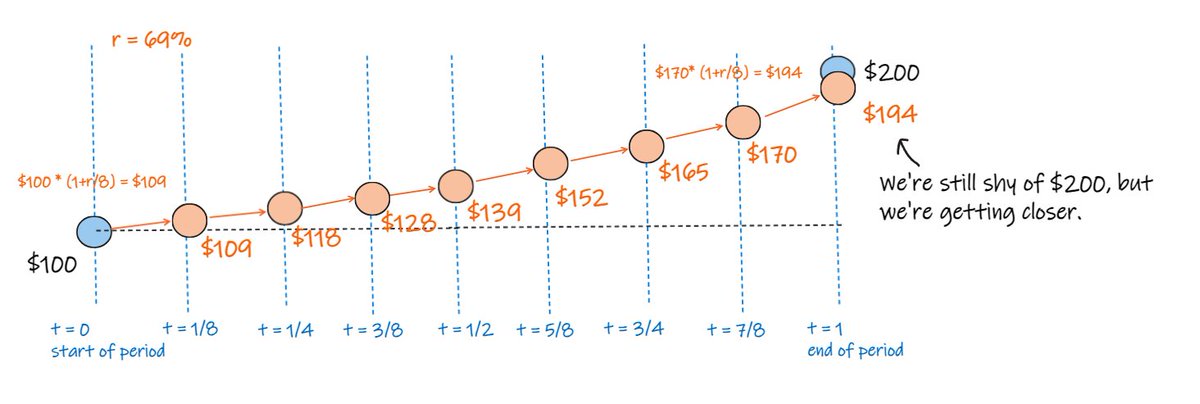

Now, split the period into eight equal periods.

And apply a return of 69% / 8 to each of the eight periods.

Now we end up at $194, which is closer still:

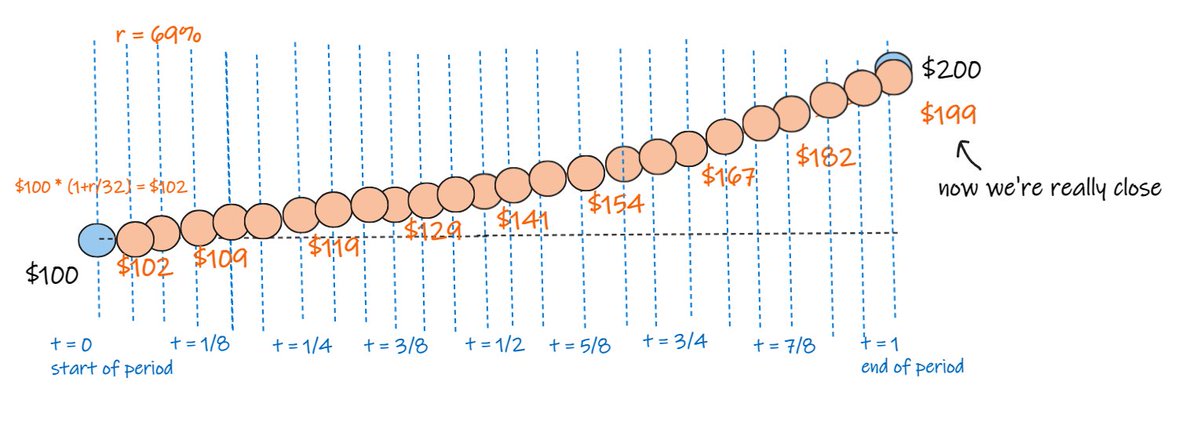

Now we split it into thirty-two equal periods.

We apply a return of 69% / 32 to each of the 32 periods.

Now we end up at $199, which is really close.

I won’t draw this, but if we divide it into 64 periods, we end up at $199.30.

And if we do this with 200 periods, we end up at $199.76

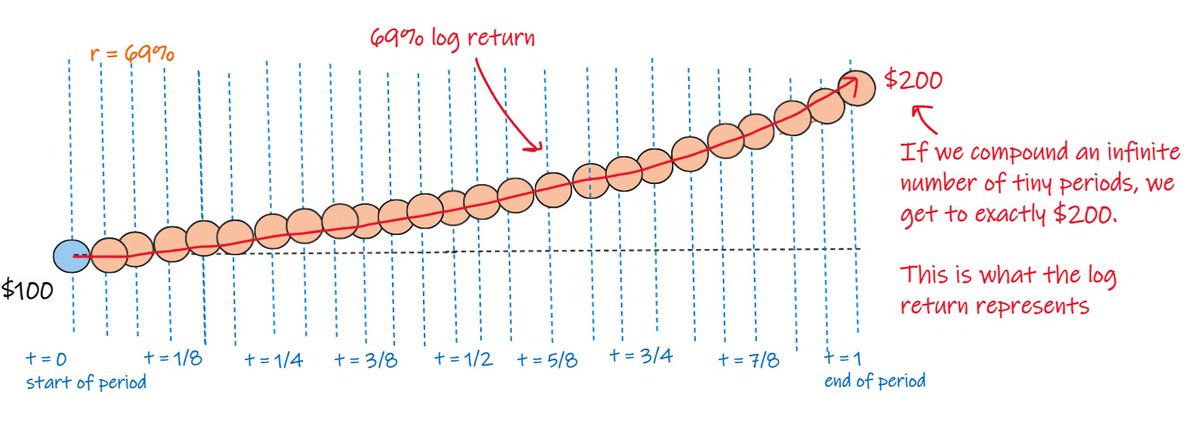

And if we do it over an infinite number of tiny periods we get to exactly $200.00.

This is what the log return represents.

Log returns are useful because:

- You can add them up over time.

- They’re easy to compare over different time periods of different lengths because they scale linearly.

- You can easily convert them into simple returns and back (see image at the top).

- They’re symmetrical on the upside and downside (if you make 10% and lose 10%, you end up at the same place.)

Thank you. This made everything super clear.

That was a great explanation!

This is awesome, thanks