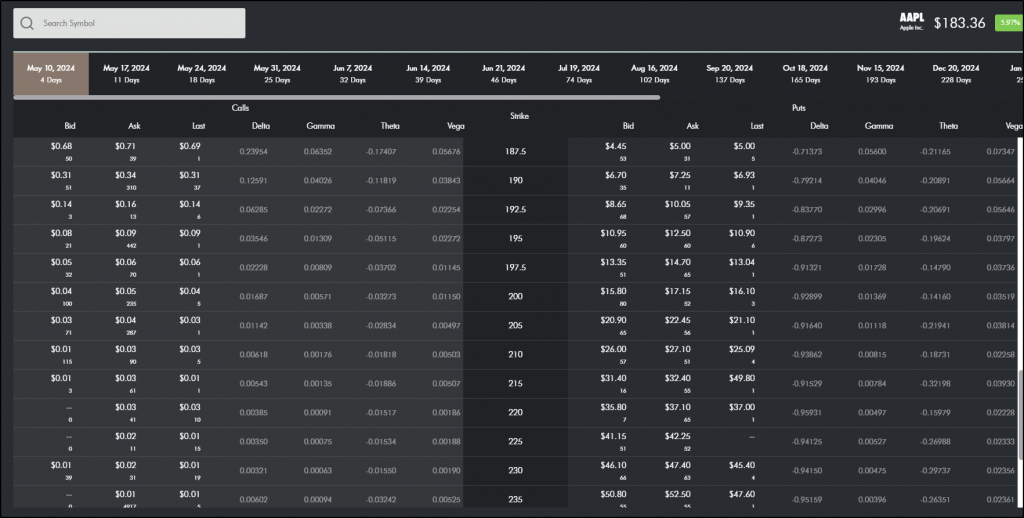

If you trade liquid stocks or futures contracts, the first thing you will notice about equity options trading is that the contracts are illiquid and the bid/ask spread is wide.

This sucks, but it makes perfect sense. There is only one AAPL stock to trade, but there are a ton of different options contracts trading against that one stock.

So, we get a lot of things to trade. Which is nice.

But each of those things is trickier and costlier to get into and out of than if we were trading the stock.

How do we deal with that?

Here are some rules of thumb.

Some Rules of Thumb for Trading Equity Options

- Don’t trade options unless you have a view on volatility or skew. If you have a directional view, it is much cheaper to trade the stock (and easier to manage, too).

- Don’t trade spreads unless you have to. Trading equity options is expensive, so you want to minimise costs. Prefer to size small and reduce risk through diversification than to spread multiple contracts on the same underlying.

- Assume the worst execution when pricing options. Always price your short trades against the bid and your longs against the ask. If the spread kills whatever edge you think you have, then don’t trade.

- Manual execution can be hard:

- If there’s a lot of open interest and price is not moving fast, then stick an order in at midpoint and be patient.

- If there’s no real open interest, then you’re going to have to hit bids and lift offers (we can’t force market makers to care). If you can afford to be patient you might want to place orders slightly inside the best bid or offer. But really, if you’re trading something very illiquid you need to have a massive edge to make it worth your while, so just get it done and move on.

- If you’re trading counter to momentum (selling an option that’s going up) then stick an order in at midpoint.

- If you’re trading with momentum, pay the spread and get it done.

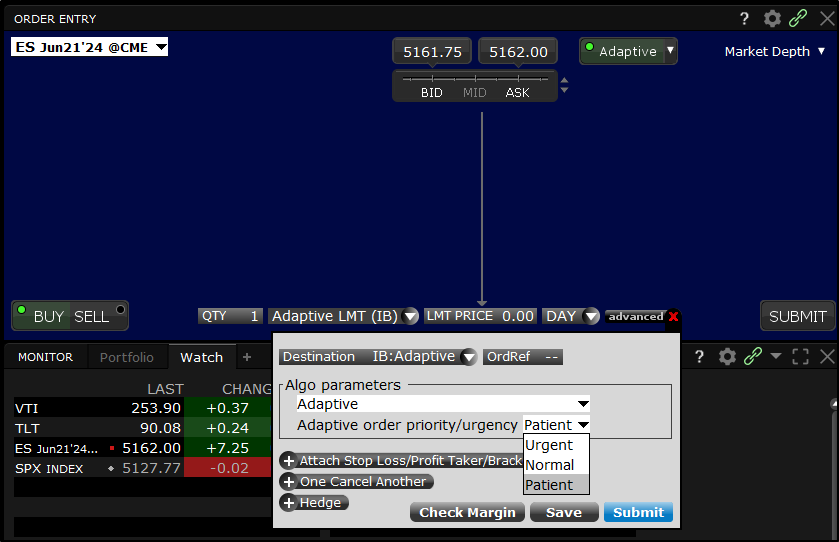

- Interactive Brokers’ execution algorithms are probably better at trading (and certainly more patient) than you are. The “Adaptive” algo on “patient” priority setting does well if you’re not in a hurry to get done.