The Winter of our Pairs Trading Discontent: Problems, limitations, frustrations

Part 3 of a series on Statistical Arbitrage for Independent Traders Previously: In the last article, we built up a

Part 3 of a series on Statistical Arbitrage for Independent Traders Previously: In the last article, we built up a

Previously: A Tale of Two Prices (the core idea of stat arb) Last time we established that stat arb is

Part 1 of a series on Statistical Arbitrage for Independent Traders. It was the age of wisdom, it was the

What’s a Fallen Angel Bond? It’s a bond that’s been kicked out of investment-grade paradise. Once upon a time, it

UVXY is an ETF that targets 1.5x the daily returns of a 30-day constant-maturity position in VX futures – the

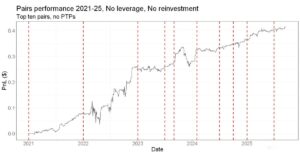

This article continues our recent stat arb series. The previous articles are linked below: A short take on stat arb

Modeling features as expected returns can be a useful way to develop trading strategies, but it requires some care. The

Every time we trade, we incur a cost. We pay a commission to the exchange or broker, we cross spreads,

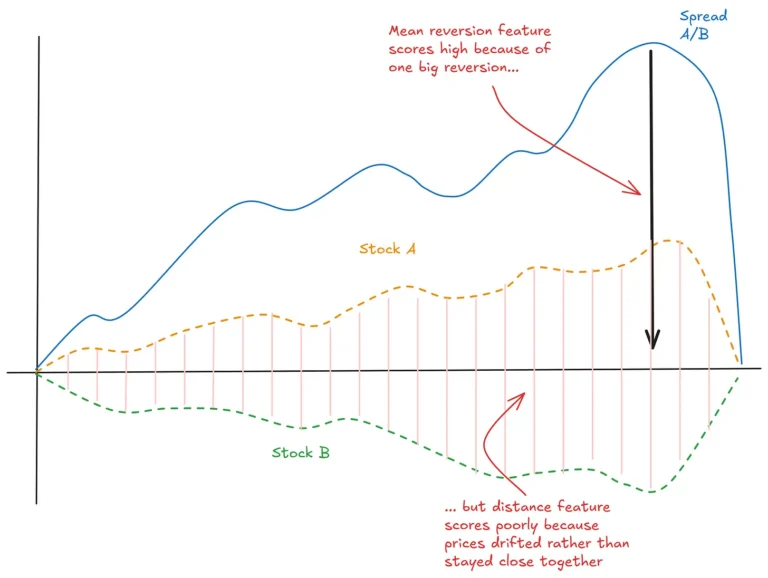

This article continues our recent articles on stat arb: In this article, I’ll brainstorm some ideas for predictive features that

Last week, I wrote a short article about statistical arbitrage trading in the real world. Statistical arbitrage is a well-understood