Stop Searching for Perfect Systems. Start Understanding

Real Edges.

Learn why your complex trading systems keep failing and how 13,000 + technical professionals like you are solving the real problem.

Like you, I once believed more complexity meant better results. That blind spot cost me time and money until one question changed everything…

Get My Free Case Study: How I Built My Trading Career as a Finance Outsider

Inside: The exact approach I used to create a trading operation that runs on part-time attention + actionable insights you can apply immediately.

As Featured In

“What’s Your Edge?” – The Question That Exposed Everything I Was Doing Wrong

I’m Kris Longmore, engineer turned systematic trader. My first “successful” strategy was pure luck – I’d built a convoluted system with parameters I’d tortured until the backtest looked perfect.

When it made money for four months then collapsed, I didn’t understand why. Later, showing off my elaborate machine-learning framework to a professional trader, he asked one simple question:

“What’s your edge?”

My blank look said it all. I was trying to solve trading with fancy tools before understanding what I was actually trading.

That moment transformed my approach. I learned edge comes first. Understanding why someone would pay you to take the other side of a trade is the foundation everything else is built on. The same understanding is what got me an equity partnership at a proprietary trading firm.

Today, I run my business from Western Australia, trading a portfolio of strategies that require only part-time attention, giving me the flexibility to focus on family, community, and personal growth.

I’m not a Wall Street insider. I’m a technical professional who learned to think differently about markets – and I built Robot Wealth to help others make the same journey.

The Technical Trader’s Dilemma

You’re smart, technically-minded, and you’ve put serious hours into your trading systems.

But despite all your effort, consistent profits remain elusive. Complex strategies that looked brilliant in backtests fall apart in live trading. You’re constantly questioning if you’re missing something fundamental.

- You’ve built sophisticated systems that fail to perform as expected when real money is on the line

- You feel anxious trading systems you don’t fully understand at a fundamental level

- You find yourself jumping from strategy to strategy, starting from scratch each time

- The skills that made you successful in your technical field seem to work against you in trading

- You’re tired of flashy trading gurus but still searching for a genuine, evidence-based approach

Beyond technical knowledge, you need to bridge the gap between your analytical mind and the reality of markets.

Start Building Your Edge Today

Join 13,000+ traders reading our free newsletter and receive my case study immediately.

Edge Alchemy: The Systematic Path to Market Understanding

Edge Alchemy is our framework for transforming market observations into profitable trading strategies. It’s built specifically for technical minds who want to redirect their analytical abilities toward genuine market understanding.

The Core Principles

Edge Comes First

Understand why someone would consistently pay you to take the other side of a trade before building elaborate systems.

Market Intelligence Beats Technical Sophistication

The markets aren’t a math problem to solve. They’re a complex ecosystem of players with different goals, constraints, and behaviors.

Find Edges Where Others

Won’t Look

The best opportunities for independent traders aren’t where everyone else is looking. They’re in corners of the market too noisy, too small, or too operationally awkward for the big players.

Multiple “Good” Strategies Beat One “Perfect” Strategy

Your greatest edge as a systematic trader is the ability to trade multiple, uncorrelated “good enough” strategies. When combined, the portfolio results can be extraordinary.

Research Like a Scientist, Implement Like an Engineer

Approach markets as a curious scientist: observe patterns, form hypotheses about why they exist, and design tests to prove yourself wrong. Only then apply your engineering skill to implement efficiently.

The RW Community: Accelerate Your Learning Curve

Trading can be isolating, especially if you’re used to collaborative problem-solving.

Our community of engineers, programmers, data scientists, and technical professionals provides:

Real-time discussion and feedback on trading ideas

Support during market drawdowns and volatility

Access to a growing library of specialized trading courses at member-exclusive pricing

Collaborative research and strategy development

A place to ask “stupid questions” without judgment

Connection with others on the same journey

“The community is the real gold in this whole experience… There are lots of experienced traders as well as new traders there to answer questions and support you on the journey.”

– Justin G.What Our Members say about Edge Alchemy

Your Path to Trading Mastery

Start with the Foundation

Free Newsletter & Case Study: Learn how I built my trading career as a finance outsider, with specific examples of edges I’ve traded and lessons I’ve learned along the way.

Get the Case StudyBuild Core Skills

Trade Like a Quant Bootcamp: Master the fundamentals of edge discovery, market understanding, and portfolio construction in our flagship program designed specifically for part-time traders.

Find out about RW BootcampJoin the Community

RW Pro Membership: Access our private community, ongoing research, webinars, and trading tools. See how trading ideas evolve over time and get support implementing your own strategies. Plus, get 50% off all our specialized trading courses.

Find out about RW ProDeepen Your Expertise

Specialized Trading Courses: Choose from our library of focused, outcome-driven courses to master specific trading strategies. Each course includes maintained code repositories, research access, and implementation tools.

Accelerate Your Progress

Inner Circle Mentoring: Get personalized feedback on your trading operation, portfolio construction, and implementation challenges through one-on-one or small group sessions with Kris and James.

What Makes Our Approach Different

We don’t promise get-rich-quick schemes or holy grail systems. Instead, we focus on:

-

Building true market understanding that lets you evaluate any potential edge

-

Developing cumulative knowledge that compounds over time

-

Supporting flexible learning paths with standalone courses you can choose based on your interests and goals

-

Creating robust portfolios rather than fragile optimized systems

-

Establishing realistic expectations about what’s possible for part-time traders

-

Supporting your journey with like-minded technical professionals

“One of the best investments you can make if you’re interested in quant trading… Hands down this is the best community I have been in. The knowledge, attitude, willingness to share and have skin in the game from Kris and James to the vast range of members including professional coders, traders, bankers and ML professionals and retail traders.”

– Adrian F.Start Building Your Edge Today

Join 13,000+ traders reading our free newsletter and receive my case study immediately.

Latest From The Blog

-

Think like a trader

Think like a traderEverything Everywhere All at Once

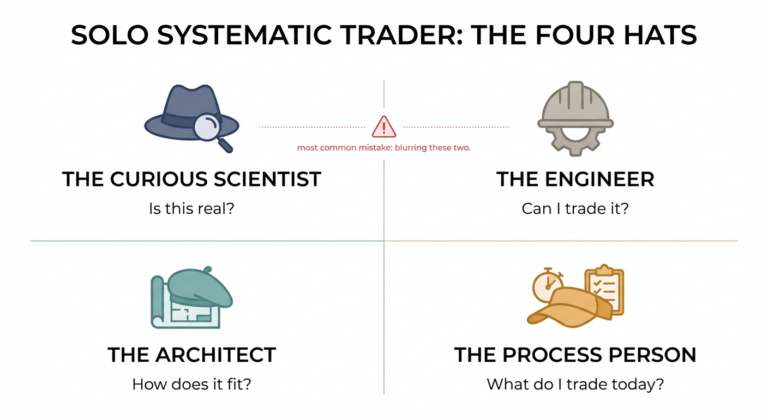

The four hats of the solo trader At a trading firm or fund, the researcher doesn’t run the execution desk.

-

Trading strategies

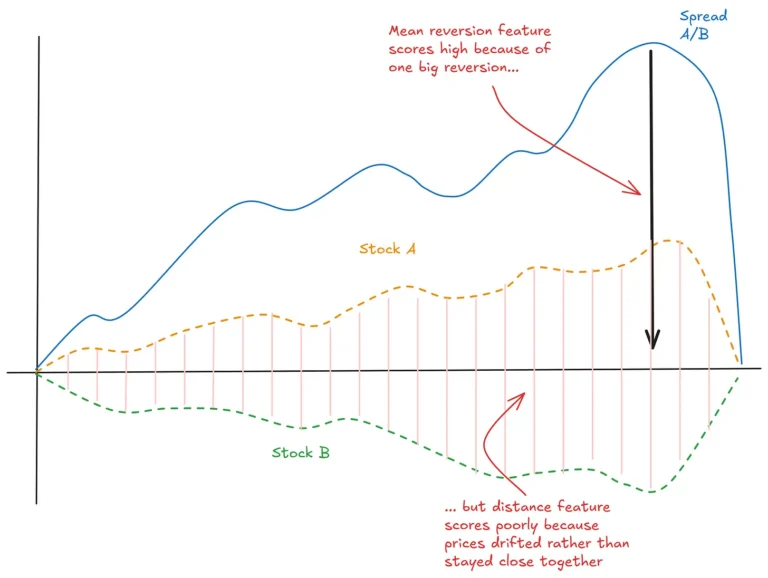

Trading strategiesThe Winter of our Pairs Trading Discontent: Problems, limitations, frustrations

Part 3 of a series on Statistical Arbitrage for Independent Traders Previously: In the last article, we built up a

-

Trading strategies

Trading strategiesMoneyball: Finding Undervalued Pairs Using Unconventional Metrics

Previously: A Tale of Two Prices (the core idea of stat arb) Last time we established that stat arb is